When I started in the business in 1995 on the floor of the Winnipeg Commodity Exchange, being the rookie, I remember running to get the StatsCan reports from the government office on the day of a big release.

Even back then, I thought it was counterproductive to worry too much about those reports. After the report was released, the markets often seemed to move up or down randomly, regardless of whether the report was considered bullish or bearish. After the fact, all the traders and brokers in the pit always had an explanation for why the market moved the way it did.

Read Also

Canadian canola prices hinge on rain forecast

Canola markets took a good hit during the week ending July 11, 2025, on the thought that the Canadian crop will yield well despite dry weather.

This wasn’t always the case, since sometimes the reports did release surprising figures that caught the industry off guard, causing a dramatic change in the prevailing commodity price trend. But even then, the move following a report can often be short lived and the prevailing longer-term trend reasserts itself.

To this day, while I follow and read the reports, I don’t get too worked up by a StatsCan or USDA report. And I certainly wouldn’t base trading and hedging decisions on the buildup or outcome of those reports. It’s helpful to understand what those reports mean, but at the end of the day, growers shouldn’t rely too much on those figures.

Recently, the March StatsCan seeding intentions report has come and gone and my response was “So what…” The main issue I have with StatsCan seeding intentions reports is they are only that; intentions. We all have intentions but for various reasons don’t necessarily follow through on all of them.

On top of that, StatsCan reports that 20 per cent of the approximately 10,000 farmers in the survey never fully complete the survey, including almost 10 per cent who refuse or simply don’t respond at all. Given there are around 55,000 grain farmers across Canada, that means the report would capture only about 15 per cent of producers. I understand you can’t survey every producer because that’s what statistics is for. So, it’s hard to get good representative data and then extrapolate it across to the whole farming population. It just leaves too much room for error, as we shall see.

Previous research I’ve done and many articles I’ve read over the years showed that seeding intentions for canola has on average been about five per cent less than estimated actual seeded acres. In some years, intentions were as much as 10 to 15 per cent too low compared to what was actually seeded.

Another concern is that the survey includes the last two weeks of March. Subsequent weather issues forced some late cropping decision changes causing acres to move between commodities.

And it’s not just an acreage issue. While there can be a big difference between intentions and what is actually seeded, there will also be further changes to expected supply by the time a crop is ultimately harvested. Of course yield, as well as acres, will have a big impact on final production levels.

The average canola yield has been about 37 bushels per acre across Canada in the past 10 years based on StatsCan numbers. Some years it’s as high as 43 and others as low as 28 bushels per acre. That’s a 54 per cent difference from lowest to highest, with the highs and lows fluctuating about 20 per cent around the average. This means there can be a lot of variability in production from year to year based on the yield alone, making estimates all the more difficult. A chart comparing recent initial production estimates for canola with final estimates gives you the picture.

Final production figures have averaged 20 per cent higher than initial estimates over the past several years with a couple of years almost 40 per cent more than initial estimates. As you can see, it’s very challenging to forecast these numbers. This underestimation has been written about many times before so it’s always good to keep this in mind when production reports are released.

So what can you do about all this?

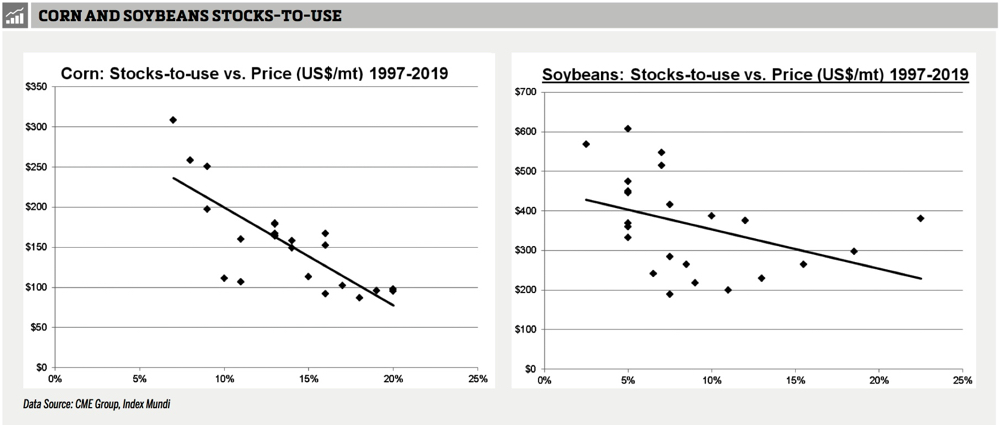

While it’s good to have an overall sense of fundamental supply-and-demand figures, since that’s what will ultimately drive the prices, don’t get too caught up in the fine details of these reports. The best indicator of price is price. At the end of the day, all you can trade is price; you can either decide to buy at that price, sell at that price, or, of course, do nothing. So for a weekly or monthly outlook, follow commodity chart patterns and trends, which are a direct measure of price. Planting intentions and production reports are simply estimates of expectations of supply which only indirectly suggest where prices might go.

Bottom line, let your profit margins and market prices guide your pricing and hedging decisions. Don’t get too influenced by the numerous agriculture reports that will be released over the coming months. With farm marketing strategies including options and futures designed to diversify your sales across time, price and strategies, one report shouldn’t make or break your crop year.