John Beckham knows world wholesale prices for fertilizer have dropped precipitously lately. But when he asks his fertilizer sales representative if retail prices will do the same, the man plays coy and pretends to know nothing about it.

Beckham is not surprised. He knows agri-retailers are sitting on piles of expensive fertilizer they bought months back when prices were high and can’t afford to sell them cheap.

“They laid in their stocks, a lot of them, in the summertime and immediately they sent their salespeople out to tell farmers they should buy now because it’s probably going to go higher,” said Beckham, who farms at Balmoral, just outside Winnipeg.

Read Also

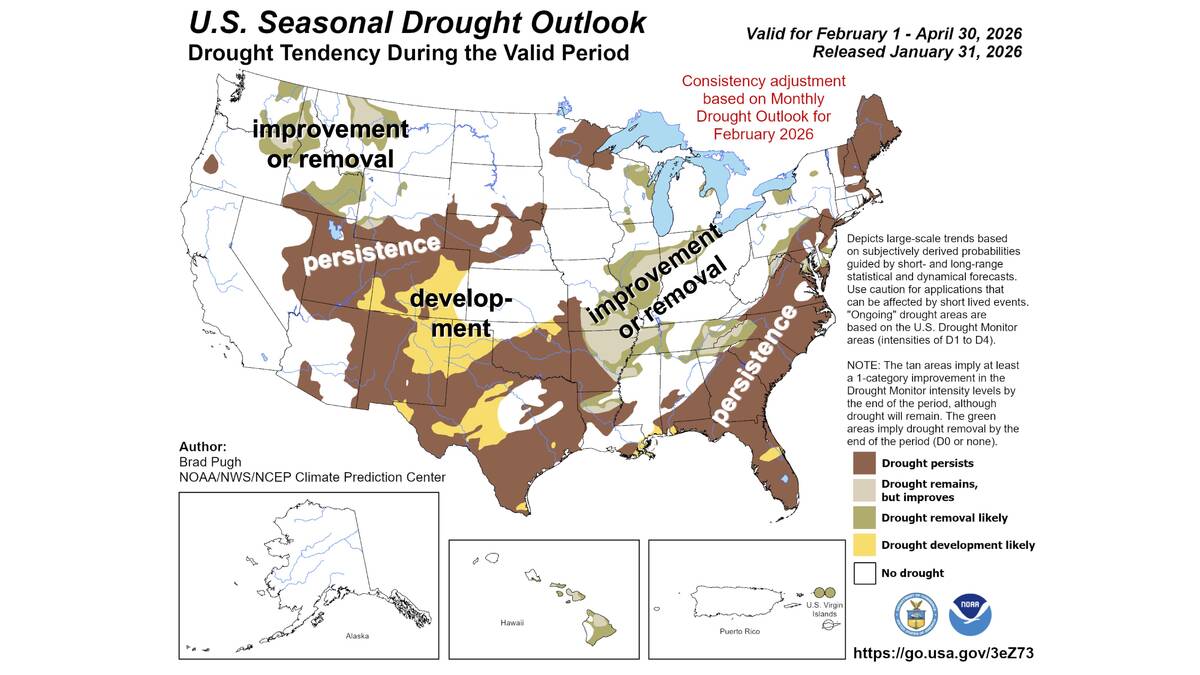

Neutral conditions drive 2026 weather as La Niña subsides

U.S. government meteorologist expects there will be neutral ENSO conditions for the 2026 farm growing season.

One farmer he knows locked in 46-0-0 nitrogen fertilizer at $795 a tonne and is now stuck with an enormous bill even though fertilizer prices began falling sharply in October.

According to industry reports, world ammonia and urea prices both fell 57 per cent within two weeks. Sulfur prices into India fell 90 per cent. Phosphate buyers in Florida are currently paying 38 per cent less.

The price collapse is a function of the global financial and credit crisis, which is causing reduced demand and higher inventories, according to David Drozd, president of Ag-Chieve Corp., a Winnipeg-based grain marketing information service.

Whether or not farmers will see the benefits any time soon isn’t clear.

“It depends on the retailer,” Drozd said during a break in a recent Keystone Agricultural Producers district meeting here. “There’s no guarantee.”

Drozd said he expected lower domestic fertilizer prices in the near-to medium-term because of lower demand, as well as lower natural gas prices.

However, demand and prices could increase again in spring, especially in Manitoba where damp autumn weather kept farmers from completing fall fertilizer applications.

Ian Wishart, KAP president, said he hasn’t seen lower prices yet, although southern U. S. dealers reportedly began price discounting product in late October. Urea and liquid nitrogen prices could decline between now and late January, he said.

KAP began conducting a member survey of local fertilizer prices last month but results were slow to come in.

Wishart suggested fertilizer companies may start blending cheap imports with existing inventories to move product at lower prices.

Clyde Graham, vice-president of the Canadian Fertilizer Institute, said industry trends are unclear because of recent volatility in world financial markets.

But growing demand for fertilizer in China and India should keep fertilizer sales strong going forward, he said. [email protected]