Improved planting conditions will allow North Dakota farmers to seed more spring wheat and durum this spring, but corn will likely steal away potential acres.

“Obviously (wheat) acres will be higher, just because so much was not planted last year,” said Jim Peterson, marketing director with the North Dakota Wheat Commission.

Five million acres of cropland in the state were left unseeded in 2011 due to excess moisture and spring flooding.

“Percentage-wise it will look like a big increase (for spring wheat and durum), but we’ll still be below our five-year averages,” said Peterson.

Read Also

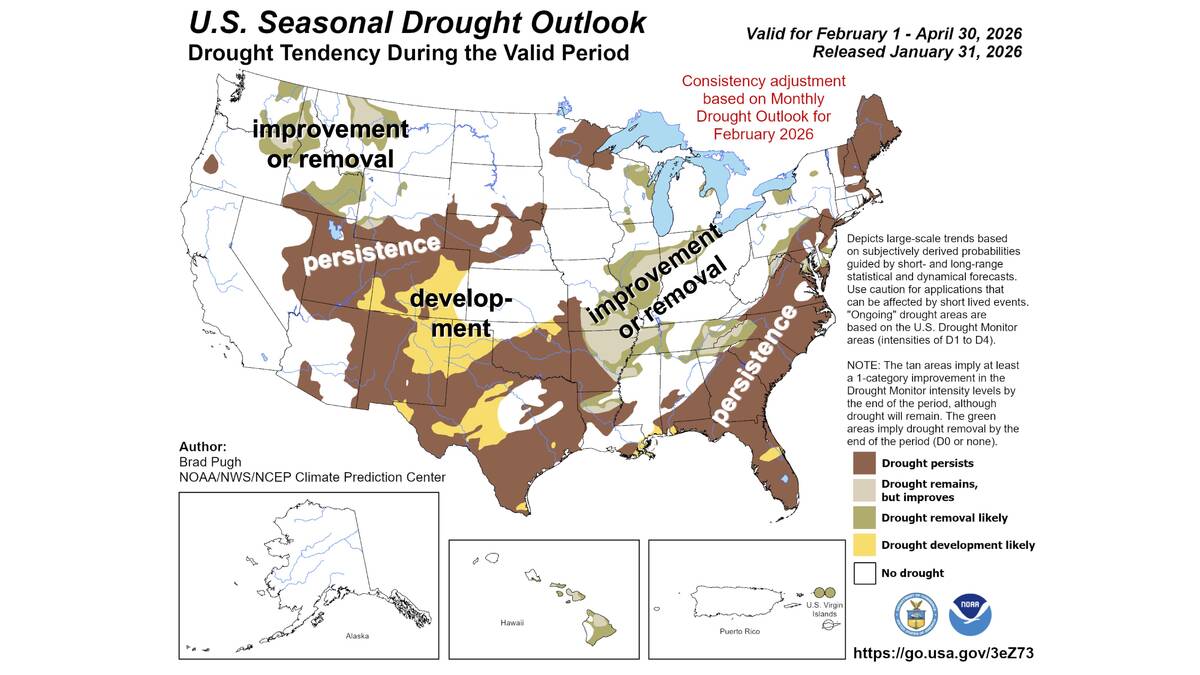

Neutral conditions drive 2026 weather as La Niña subsides

U.S. government meteorologist expects there will be neutral ENSO conditions for the 2026 farm growing season.

“Corn is competing hard this year” and will likely take away some wheat acres in the southeast corner of the state, and high corn prices should also see more corn planted farther west as well, he said.

Based on seed sales and meetings with producers, Peterson predicted spring wheat acres in the state will be about 6.3 million, which compares with 5.7 million the previous year and 6.4 million in 2010. In 2011, initial intentions had been for spring wheat acres as high as 7.1 million acres, before the adverse spring weather arrived.

A rally in new crop bids over the next month “could pull in a few more acres,” said Peterson. An early start to spring seeding would also favour spring wheat, possibly pushing acres as high as 6.5 million, according to Peterson.

For durum, North Dakota area dropped to about 700,000 acres in 2011 and producers in the prime growing region in the western part of the state were looking to get back into the crop this year, said Peterson, who forecasted 2012 area at about 1.5 million. In 2010, North Dakota farmers planted 1.8 million acres of durum. Strong crop insurance coverage, which is better than the coverage for spring wheat, will also encourage some additional acres, he said.

However, additional winter wheat plantings in some areas, and a lack of a significant premium over spring wheat in the cash market would limit durum acreage increases.

U.S. farmers are also closely watching the Canadian situation, and the end of the Canadian Wheat Board’s single desk is creating some uncertainty. Peterson said he expects an open Canadian market will benefit the North American wheat and durum market as a whole in the long run by creating more transparency. However, he said opinions are divided on the short-term implications. The possibility of increased Canadian deliveries into American elevators concerns some U.S. growers as they would weigh on prices. Others expect there will be more export opportunities for U.S. suppliers, he added.