An erosion of both resources and clout limits the ability of governments to protect farmers from the effects of market concentration, a U.S. farm leader told farmers attending the recent Keystone Agricultural Producers meeting.

“Enforcement is a big problem and a growing problem,” said Roger Johnson, president of the American National Farmers Union.

“In the U.S., and frankly, around much of the world, you have shrinking investment going into government institutions and you also have an anti-regulatory mania that is very prevalent.”

Johnson spoke to producers about the effects and fallout of market concentration during Keystone Agricultural Producers annual general meeting in Winnipeg last month. He said not only are mergers becoming bigger and bigger, but regulatory bodies are becoming weaker.

- Commodity collaboration, mergers to be discussed at CropConnect ’17

- Comment: Closing the barn door after the fact

Companies are often allowed to merge provided they agree to meet certain requirements, such as keeping up particular infrastructure or divesting themselves of some assets, but Johnson said if companies don’t hold up their end of the bargain there is often little that can be done.

“It’s a concern,” said KAP president Dan Mazier, adding he’s seen first-hand examples of companies that merge only to shutter local infrastructure they were supposed to maintain.

Shawn Hashmi of the Canadian Competition Bureau said people who notice merger conditions are not being met should notify the bureau as an independent law enforcement agency.

But exactly what actions are taken against a non-compliant company remained unclear as Hashmi explained the legal considerations faced by the bureau, describing the situation as one where they are often “handcuffed.”

Exactly what percentage of proposed mergers and acquisitions are approved by the bureau also remained unclear as Hashmi sought to explain the complex burden of proof the bureau is required to provide in order to prove that a merger will damage an industry.

“We can’t block every merger that results in concentration, that’s just the reality of it,” he said.

Read Also

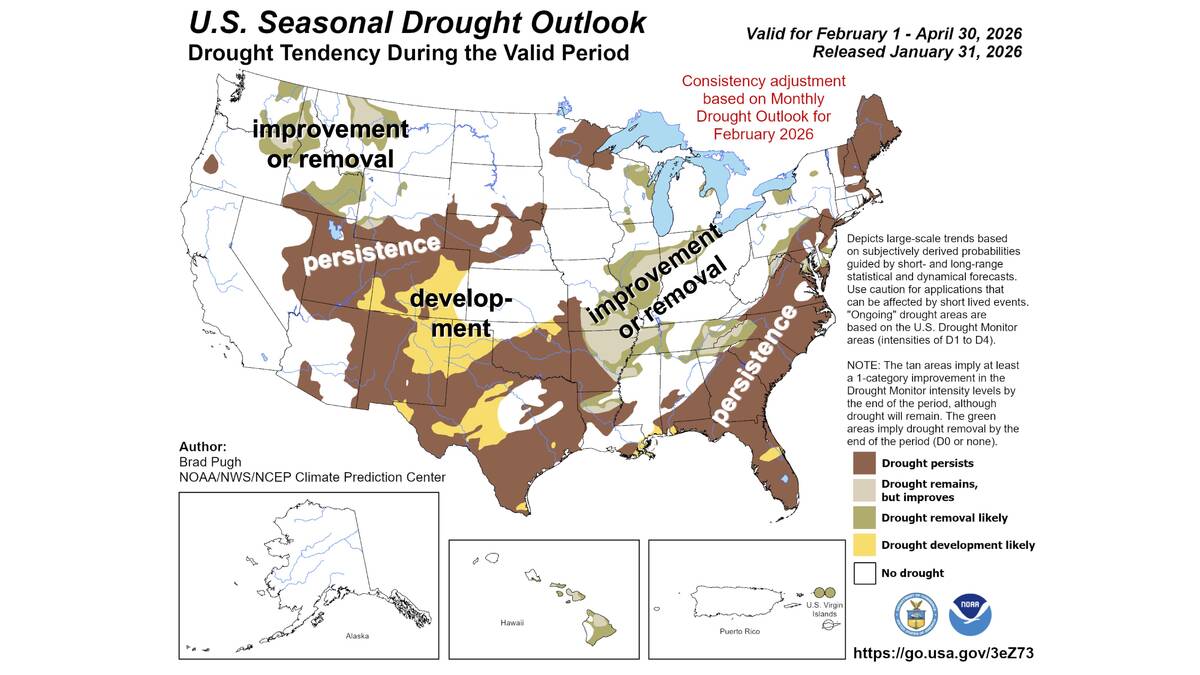

Neutral conditions drive 2026 weather as La Niña subsides

U.S. government meteorologist expects there will be neutral ENSO conditions for the 2026 farm growing season.

Dean Harder of Lowe Farm pointed to the breakup of the American telecom giant AT&T in the early 1980s, asking if regulators in either Canada or the U.S. still had that kind of clout.

“I think farmers are constantly getting used to being cheated in these merger deals and going, yeah, nothing I can do about it, but maybe there is more,” he said. “Is it that the organizations that exist in America, in Canada need more teeth?”

Johnson said that, at least in the United States, there has been a gradual erosion of enforcement power, even though the actual laws governing competition have remained relatively unchanged since the time of Franklin D. Roosevelt.

“These mergers are a very, very big problem for us,” he said. “As a result, we’re probably going to have fewer choices that are going to be available to us, which has enormous implications for anyone outside of sort of the core production area in the U.S. — the corn and bean country — everything outside of that is almost deemed as being special crop, so as consequence, most of Canada falls into that category.”

The potential upside is that smaller companies could move in to fill the gaps left in special crop industries, said Johnson.

“If we’re going to keep approving these mergers, we have to have other public policies in place that are going to encourage the development of new entrants, smaller entrants, maybe niche marketers and protect them for the kind of market power dominance that might be inclined to come from these big companies,” he said.

However, changes in American politics could present yet another hurdle to responsible regulation, Johnson added, noting the presidency of Donald Trump has already proven to be unpredictable. Even before Trump was inaugurated, he sat down with Bayer and Monsanto to discuss and endorse their planned merger.

“It was concerning that meeting was even allowed to proceed,” he said. “When that meeting had happened, he had still not named a secretary of agriculture, so I think a lot of folk in agriculture are thinking, wow, so he’s got time to meet with the largest seed company in the world and the largest pesticide company in the world, that are wanting to get together… those deliberations are required to be especially non-political and very specifically focused on the facts, so that raised a bunch of other questions about what is going to happen.”

It was at that meeting the heads of those companies promised to invest $8 billion in research and development if the planned merger goes forward — the same amount they are already spending on research and development, Johnson said.

A promise typical of most merger proposals also emerged from the meeting, the promise of more jobs.

“I haven’t talked to a person yet who believes that as a result of a merger more people will be hired, that is so antithetical to what happens in mergers that it’s hard to understand that that could be the case,” Johnson said.

“You certainly got the sentiment from the crowd here that there is a sense that these things are kind of inevitable,” he said. “And that as a consequence, we as farmers, producers are going to end up paying the price no matter what happens.”