Russian fertilizer producer Uralchem would be interested in buying the Russian assets of global grain traders Viterra and Cargill if they decide to leave Russia, the company said in a letter seen by Reuters.

Spokespersons for Cargill’s and Viterra’s Russian operations said their respective companies do not plan to leave the country. Uralchem declined to comment.

Dozens of foreign firms, including McDonald’s, have left Russia since Moscow sent thousands of troops to Ukraine on Feb. 24. However, food supplies are not targeted by Western sanctions, and Viterra and Cargill continue operating in Russia.

Read Also

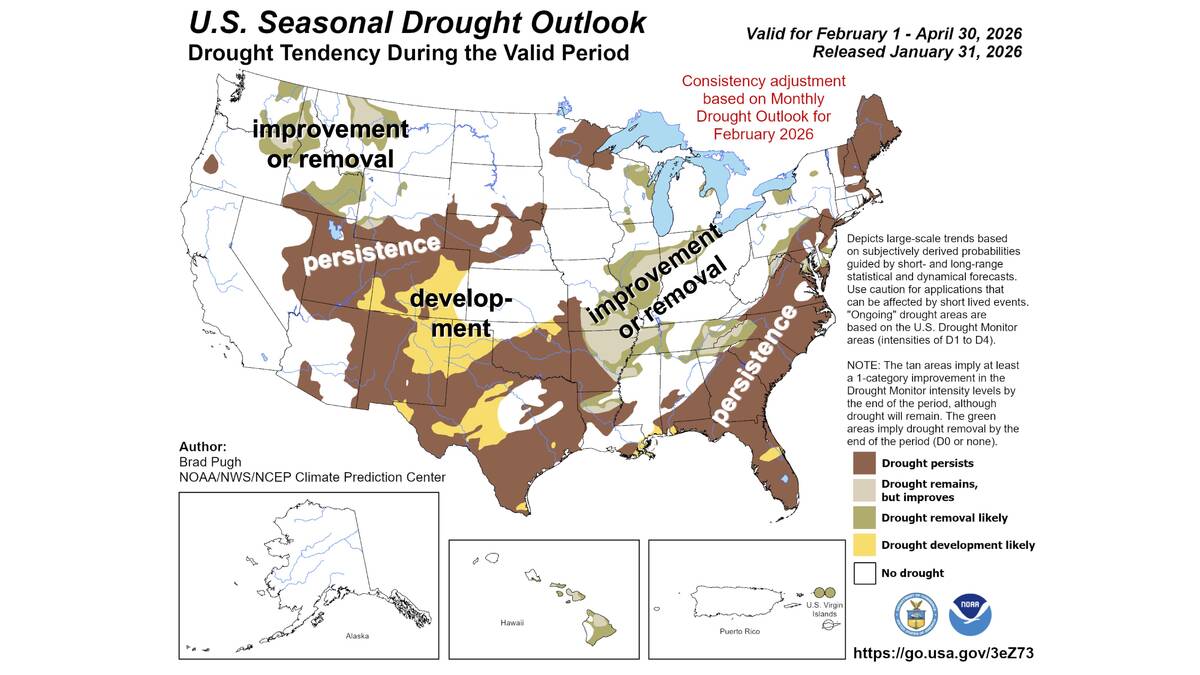

Neutral conditions drive 2026 weather as La Niña subsides

U.S. government meteorologist expects there will be neutral ENSO conditions for the 2026 farm growing season.

In a letter sent by Uralchem Chief Executive Dmitry Konyaev to President Vladimir Putin on Nov. 21, the company asked the president to support its proposal, saying that Viterra’s and Cargill’s grain trade overlaps with Uralchem’s business.

On Nov. 22 Putin signed “agree” on the letter and instructed Prime Minister Mikhail Mishustin to consider the proposal.

[RELATED] From Ukraine: Rebuilding in the ashes

The existence of the letter was first reported by Russia’s Kommersant newspaper.

Russia is the world’s largest wheat exporter and a major supplier of fertilizers to global markets.

Uralchem wants to become a grain trader because many Russian farmers who sell grain overseas via foreign commodities houses such as Viterra and Cargill purchase fertilizers from Uralchem, a source at the company told Reuters.

“The assets of these companies offer good synergy effect. But so far, we are only talking about negotiations, which could be initiated if Viterra and Cargill are interested,” the source said.

Without their consent to leave, “no one would be twisting their arms,” the source added.