Reuters – Agricultural chemical and seed company Corteva raised its full-year forecast May 3 after it beat quarterly profit estimates.

The company’s performance was aided by higher prices and strong demand for seeds, sending its shares up two per cent in extended trade.

Crop prices have scaled back after rising to record highs last year as Russia’s invasion of Ukraine hit grain supplies, but they remain higher than historical levels. Farmers have prioritized yields to benefit from high prices and offset rising inflation.

Read Also

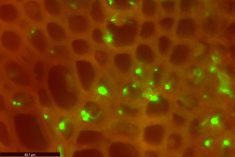

Potato growers beware new PVY strains

Newer strains of potato virus Y (PVY) are creating headaches for potato farms in Eastern Canada, and Manitoba farmers should pay attention

The company, spun off in 2019 after a merger of Dow Chemical and Dupont, raised its full-year 2023 sales forecast from US$18.6 billion to $18.9 billion, a growth of seven per cent at the mid-point. Analysts, on average, expect $18.49 billion.

“Tight global grain supply continues to put pressure on ending stocks, keeping crop prices above historical averages and farm income levels healthy,” company CEO Chuck Magro said in a statement.

Corteva’s operating core profit came in at $1.16 per share in the quarter ended March 31, compared with the analysts’ estimates of 93 cents.

Net sales from its seed business rose seven per cent to $2.70 billion during the first quarter as higher prices offset decline in volumes due to delayed soybean harvest and supply constraints in South America.

Its crop protection segment also posted a five per cent rise in net sales.

Peer company Syngenta had also reported higher quarterly sales and profit in April by raising prices to offset higher costs caused by more expensive chemicals and transport.