Expanding Down Under has boosted the bottom line for grain handler Viterra in fiscal 2010.

Canada’s largest grain handler, which bought Australia’s ABB Grain in September 2009, on Jan. 19 booked its first full fiscal year including the Adelaide-based grain firm’s revenues and expenses.

Viterra reported profit of $145.27 million on $8.256 billion in revenues for its year ending Oct. 31, up 28 per cent from $113.13 million on $6.632 billion in fiscal 2009.

The Regina-based grain firm credited its Australian operations for $2.3 billion of its 2010 revenues, on top of revenue from its recent purchases in U.S. food processing.

Read Also

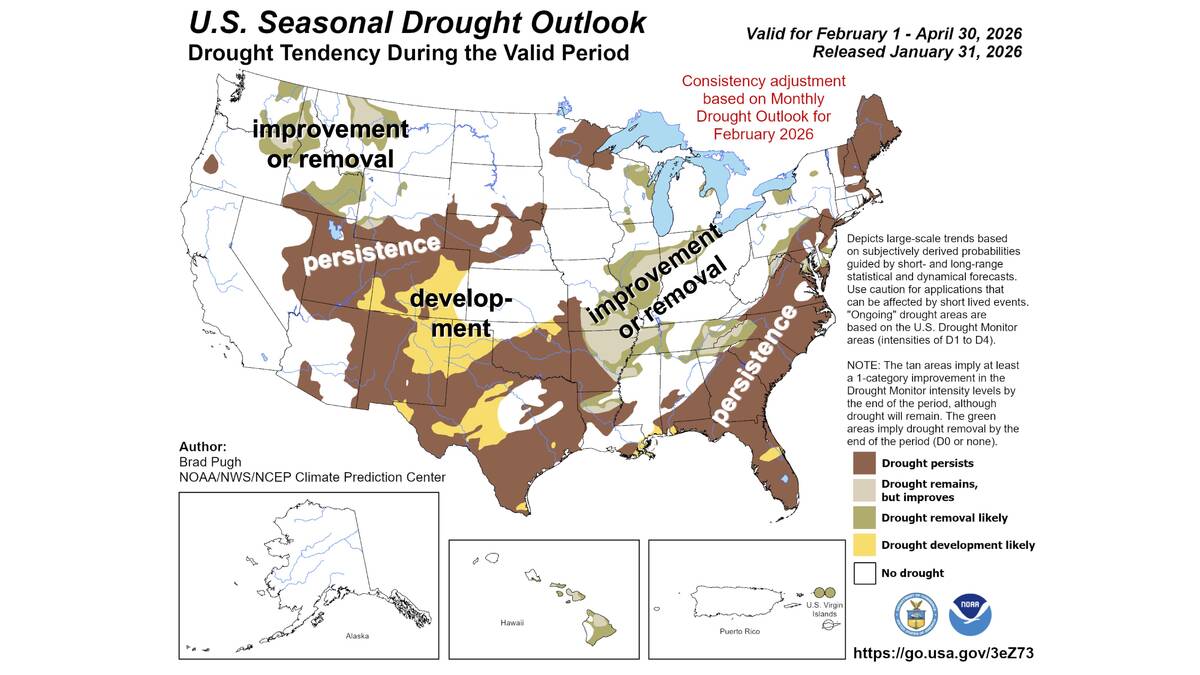

Neutral conditions drive 2026 weather as La Niña subsides

U.S. government meteorologist expects there will be neutral ENSO conditions for the 2026 farm growing season.

Those increases, the company said, were “partially offset” by lower volumes and commodity prices in Viterra’s North American grain-handling business.

The company’s 2010 earnings before income, taxes, depreciation and amortization (EBITDA) on grain handling and marketing thus rose to $386.1 million – up from $247.9 million in 2009.

EBITDA from the agriproducts division, including crop inputs and ag retail operations, was up at $153.8 million from $132.3 million in 2009. Viterra’s processing arm booked 2010 EBITDA of $104.3 million, up from $36.5 million.

Looking at the broader grain industry, Mayo Schmidt, CFO of Viterra noted flooding in parts of Australia, droughts in Argentina and potentially damaging frosts in Europe have “tightened supply and pushed commodity prices up, allowing them to return from the soft pricing environment experienced during the last two years.”

With ABB on board, he said, Viterra is “ideally situated with a strong leadership position in origination from both North America and South Australia. In fact, South Australia is currently harvesting what is expected to be a record-setting crop.”

Looking ahead into 2011, Viterra now estimates its global pipeline margin per tonne for fiscal 2011 will be in the range of $33 to $36 per tonne, up from its guidance of $30 to $33 per tonne in 2010.

That increase, the company said, will reflect a full year of gross profit expected from the company’s International Grain group, now “fully established” including new trading offices in Italy and Ukraine.

However, Viterra’s chief operating officer Fran Malecha was quoted by the Canadian Press on the company’s conference call as saying the company will also increase its storage and handling fees in 2011, both in Canada and in Australia.