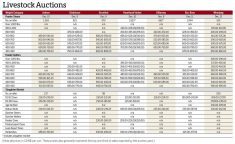

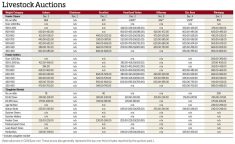

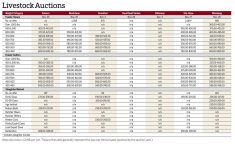

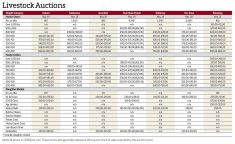

For the week ending Jan. 18, western Canadian feeder cattle markets were relatively unchanged compared to seven days earlier.

U.S. president Donald Trump was set to be inaugurated Jan. 20, and feedlot operators were concerned about potential tariffs on fed cattle and beef products.

On Jan. 16, Alberta packers were buying fed cattle on a dressed basis from $438-$442, which was $3-$4 higher than seven days earlier.

Read Also

Market impacts of canola headlines need digesting

January 2026 has been quite the month for Canadian canola trade, how will it all ripple out in the market?

On a live basis, fed cattle prices f.o.b. southern Alberta feedlot were quoted in the range of $273-$275, up $3 to $5 from the previous week.

Alberta feeding margins for nearby delivery continue to improve, which was supportive for the feeder complex. However, buyers were not anxious to push the market higher.

U.S. wholesale beef prices were quoted at US$333 per hundredweight on Jan. 16, unchanged from the close on Jan. 10. The deferred live cattle futures have consolidated at contract highs over the past week, which contributed to the steady tone in the feeder market.

Feedlot profits

It appears there are profitable margins on cattle that were placed last fall. Feedlot operators are being aggressive to reload, with noted Ontario demand in the eastern Prairie regions.

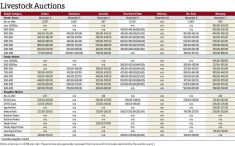

Looking back at prices for the week ending Jan. 11, south of Edmonton, Simmental-Gelbvieh blended steers averaging 950 pounds on a light barley and hay diet with full processing data sold for $360.

East of Edmonton, black mixed heifers on light grain and silage diet weighing 955 lb. were valued at $325.

At the Heartland sale in Yorkton, Sask., tan steers weighing 865 lb. dropped the gavel at the psychological $400 per cwt. level. The Yorkton site allows for direct transport (without unloading stopover) for Ontario feedlots.

Prices at this auction were at a $15-$20 premium over Alberta in some cases. For example, in central Alberta, Simmental-Angus blended steers weighing 864 lb. coming off a light grain and silage diet with full processing were last bid at $376.

Near Calgary, tan weaned steers weighing 700 lb. were valued at $458.

In central Alberta, Simmental mixed red heifers averaging a hair under 700 lb. silenced the crowd at $400.

At the Westlock, Alta., sale, Angus Simmental blended steers weighing slightly more than 600 lb. on a barley and silage diet charted course at $482.

The market report from the North Central Livestock Exchange in Clyde had higher quality 500 lb. steers reaching up to $571.

A buyers’ report from central Alberta had tan heifers averaging 540 lb. trading for $460.

At the Whitewood, Sask., auction on Jan. 7, black steers weighing a shade under 500 lb. sold for $547 and a handful of red heifers with a mean weight of 553 lb. reportedly sold for $400.

The April live cattle futures reached $199.70 on Jan. 10, which would result in an Alberta cash price of $283-$285 for March and April.

Alberta break-even pen closeouts for April are around $260-$265. Feedlots will bid up the price of replacements until there is no margin. Feeder cattle values jumped about $200-$250 per animal over the past week.

For Manitoba prices, see our top livestock story on page 13.

Trends

This is a demand-led rally as wholesale beef prices trade at or near 52-week highs. Beef prices usually soften in January and February, but values are moving in a contra-seasonal trend this January.

There are four main reasons for this price behaviour in the wholesale market.

In past years, quarterly beef production increased in the third and fourth quarters. For 2025, beef production in the third and fourth quarters will be sharply lower than in the first half of the year and down sharply from the same period of 2024.

In addition to the lower production, the actual timeline of the U.S. border opening to Mexican feeder cattle is uncertain. Mexican feeder cattle take about 30-45 days longer to finish compared to U.S. and Canadian feeder cattle.

Thirdly, U.S. packing plants are also concerned about the potential effects of U.S. president Donald Trump’s threatened tariffs. Canadian fed cattle sales contracts become void upon implementation of tariffs. It’s a term in the contract.

Finally, beef demand makes seasonal highs in the spring and summer period.

U.S. packers are hesitant to make wholesale beef sales in the deferred positions.

Large companies such as McDonald’s usually buy beef on long-term contracts. The uncertainty in production in the deferred positions has resulted in a risk premium for the wholesale beef market in the short term.

Looking forward, beef demand will increase while production decreases. Packers are taking into account a worst case scenario for third and fourth quarter beef production.

When a country implements tariffs on an imported product, the tariff punishes consumers of the importing country by raising prices.

Beef demand is inelastic. A small change in supply has a large influence on the price. For commodities or products that have inelastic demand, the punishment weighs more heavily on consumers for the importing country.

For example, in the case of a 10 per cent import tariff on beef or cattle, approximately seven to eight per cent would be borne by the importing country through higher prices.

The supplier in the exporting country would be punished by lower prices of two to three per cent.

Don’t lose too much sleep over a 10 per cent tariff with feeder cattle prices at historical highs. It’s a tariff; it’s not border closure. Feeder cattle prices just jumped $20 per cwt. in Western Canada over the past month.