WINNIPEG, Dec. 29 (MarketsFarm) – Intercontinental Exchange (ICE) Futures canola contracts closed stronger on Tuesday, with activity concentrated to deferred months as the January contract nears its expiry. Contracts are nearing chart resistance levels of around C$250 per tonne.

Chicago soybeans hit multi-year highs on the day, with canola following suit. The January soyoil contract closed around 42.5 U.S. cents per pound.

Continual strength in the Canadian dollar kept a lid on further gains for canola. The loonie was around 78 U.S cents.

Today, 43,496 contracts were traded, which compares with Thursday when 17,110 contracts changed hands. Spreading accounted for 11,554 contracts traded.

Read Also

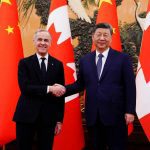

Canadian Financial Close: Loonie higher, Greenland threats weaken markets

Glacier FarmMedia – The Canadian dollar moved higher on Tuesday as its United States counterpart fell back. The loonie…

SOYBEAN futures at the Chicago Board of Trade (CBOT) closed stronger on Tuesday, following the weekly export inspection report from the United States Department of Agriculture (USDA).

Last week, 1.4 million tonnes of soybeans were inspected for export.

Argentina’s government has entered negotiations with striking dockworkers in an attempt to end the weeks-long strike at the country’s shipping ports. The strike has reportedly prevented more than 170 export ships from being loaded. Grain processors have reportedly been offered wage increases and a pandemic bonus, amid high inflation.

One private advisor left their estimate for the Brazilian soybean crop unchanged at 130 million tonnes, and lowered the Argentine soybean crop estimate by a million tonnes to total 47 million.

CORN futures were also stronger today.

Approximately 990,000 tonnes of corn were inspected for export last week.

There are reports that key growing regions in South America have received rain, though it may have come too late to make much of a difference for crop yields.

A crop advisor left their estimate for the Brazilian corn crop unchanged at 102 million tonnes and lowered his estimate for the Argentine corn crop 1.0 million tonnes to 46 million tonnes.

WHEAT futures were also stronger today, following reports that Argentina’s shipping port strike prevented approximately 10 ships from loading Argentine wheat headed for Brazil. A Brazilian industry group indicated that wheat flour production in the country could be disrupted at some mills if the strike does not end soon.

At approximately 304,000 tonnes, USDA export inspections of wheat were down 22.5 per cent from the previous week.

END