By Glen Hallick, MarketsFarm

WINNIPEG, Aug. 6 (MarketsFarm) – ICE Futures canola contracts were steady to higher at midday Thursday, due to “a mixture of technical and commercial buying,” according to a Winnipeg-based trader.

He said there had been support from other vegetable oils in the overnight trading. However, Malaysian palm oil retreated to finish lower and European rapeseed was steady to higher.

As for Chicago soyoil, it too had been higher earlier in the session, “but it’s clinging to small gains now,” the trader commented.

Read Also

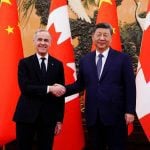

North American Grain/Oilseed Review: Canola up on new trade deal, positives for U.S. grains, oilseeds

Glacier FarmMedia — Canola futures on the Intercontinental Exchange were higher on Friday, hours after Canada and China announced a…

The results of a crop tour conducted by private analysts FarmLink were described as “phenomenal,” by the trader. Wheat (excluding durum) was projected to yield 60.5 bushels per acre with production to be 31.9 million tonnes. Durum was estimated at 45.3 bu/ac. with production pegged at 7.0 million tonnes. Canola yields were forecast at 42.9 bu/ac. and production at 20.2 million tonnes.

“The canola number, if anything, sticks out as maybe being on the low side,” the trader said.

The Canadian dollar was slightly higher at 75.55 U.S. cents, compared to Wednesday’s close of 75.40.

Approximately 8,600 canola contracts were traded as of 10:40 CDT.

Prices in Canadian dollars per metric tonne at 10:40 CDT:

Price Change

Canola Nov 490.00 up 1.60

Jan 496.00 up 1.00

Mar 499.90 up 0.30

May 503.60 up 0.20