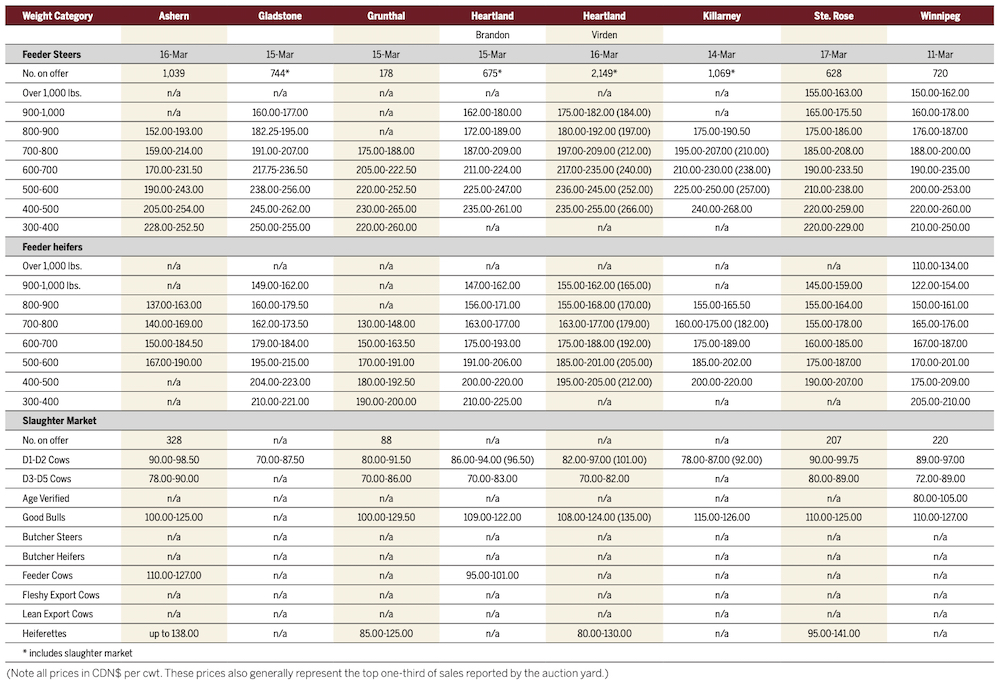

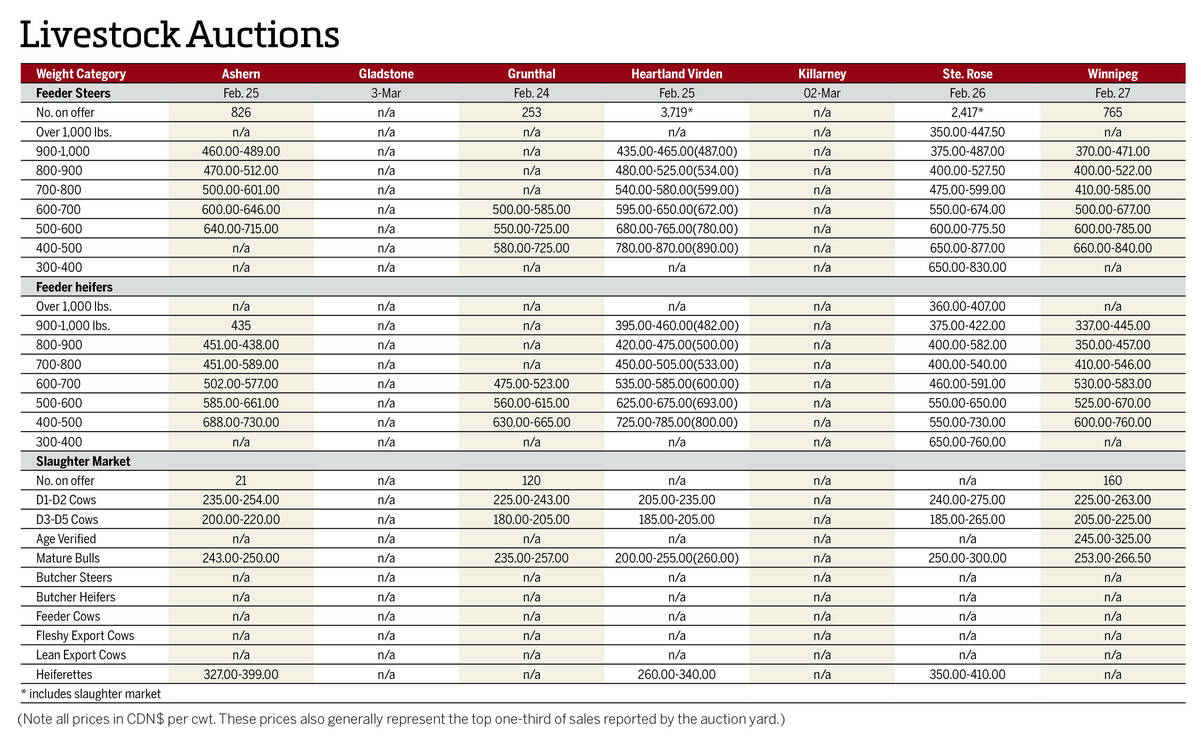

Similar numbers of cattle went through the rings at Manitoba auction sites for the week ended March 17 compared to last week. However, fast-rising fuel costs may change cattle prices in the short term.

In total, there were 8,045 cattle sold during the week. During the previous week, at least 7,637 animals were brought to auction (excluding numbers from Brandon and Gladstone). While Virden saw an increase of 1,210 in the number of cattle at its regular auction on March 16 compared to the previous week, declines in numbers were seen at Winnipeg, Grunthal and Ste. Rose.

Read Also

Manitoba cattle prices, March 4

Chart of weekly Manitoba cattle prices.

Steers benefited most from higher prices. Lightweights weighing 600 pounds or less sold for at least $190 per hundredweight. Heavyweight steers did not sell for any less than $150/cwt, compared to the low price of $124 one week before. Increases were seen at both ends of heifer prices.

“We saw a significant rebound on the steers, essentially. All the steers were higher,” said Allan Munroe, manager of Killarney Auction Mart. “Heifers were improved, but there’s a very wide spread between heifers right now.”

However, the cattle industry is watching fuel prices very closely as the rising costs of diesel and gasoline, brought on by sanctions related to Russia’s invasion of Ukraine, are affecting feed grain prices, and in turn, cattle prices.

“We saw significant effects on (cattle prices) initially, but it seems like people are adjusting to that reality and they were seeing some optimism on the feeder market as people adjust to what looks like is going to be normal,” Munroe said. “I was perfectly surprised to see prices increase the way they did and I’m not 100 per cent sure why they did, but I’m glad to take it.”

On the Chicago Mercantile Exchange (CME), the April live cattle contract closed at US$138.40/cwt on March 17, slowly making its way up after hitting a six-month low of US$133.50 on March 4. The April feeder contract hit a nine-month low on March 4, but has since risen by more than US$7 to close at US$161.10/cwt on March 17. However, the Canadian dollar has risen 0.78 of a U.S. cent from a week earlier, tempering price gains.

As well as there being strong local demand, interest from Eastern Canada has yet to wane due to rising fuel costs, according to Munroe.

“The East still seems to be very keen on Manitoba cattle,” he said. “It’s costing more to get cattle to that direction, but they still seem very bullish on the market and they’re grabbing those top-end cattle.

“Right now, we’re seeing a rising market, which is a good thing. The cattle have been sold due to feed availability. I think there will be some cattle moved here over the next few weeks and I think we’ll start seeing a seasonal slowdown fairly shortly after that.”