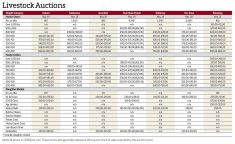

Cattle prices are up compared to last year, but pressure was apparent at auction sales across Manitoba during the week ended Nov. 16.

Most sales saw declines in both volume and price. At Gladstone Auction Mart’s regular sale on Nov. 14, most prices for heavyweight and lightweight cattle were down compared to one week earlier. As for D1 and D2 slaughter cows, the minimum price was $8 per hundredweight lower, while the price for mature bulls was down $5/cwt. on the lower end.

Tyler Slawinski, auctioneer at Ashern and Gladstone auction marts, said cattle weighing 600 pounds or more were pressured most, partly due to lower United States futures prices.

Read Also

No easy fix for canola as Carney meets Xi in Beijing

China’s tariffs push pain on farmers into 2026. Growers are hopeful for political resolution as PM’s trade mission begins.

“Heavier feeder cattle, based on the futures, going outwards where those cattle finish were definitely under pressure,” Slawinski said. However, greater demand supported the heifer market.

“Grass-type (cattle) weighing 600 (lb.) or lower were steady to stronger in spots,” he said. “More guys are starting to come on board buying heifers and it was supporting that market going forward.”

After cattle prices on the Chicago Mercantile Exchange took a large drop on Nov. 9 and reached a nine-month low the next day, they were in recovery mode for most of the week until another price drop on Nov. 16.

All in all, the February live cattle contract gained 85 U.S. cents over the week to US$175.325/cwt. on Nov. 16, after hitting a week-long high of $179.050/cwt. the previous day. The January feeder cattle contract closed at $227.500/cwt. on Nov. 16, a weekly gain of $2.575.

Mild weather during the week caused adverse pen conditions for backgrounding and weaning cattle, according to Slawinski. Different situations in both Western and Eastern Canada have created new obstacles.

“We have a lot of feedlots in the west that don’t have any room for cattle right now, which is also bearish on the market,” he said.

“Ontario is way behind in their harvest and fat cattle are still backed up in the feeder farms there. Once they can get some of the fat cattle out of the way (with) those barns cleaned out and emptied, I think we’re going to see a lot of relief on pressure.”

However, an opportunity presented itself for local producers.

“We’re starting to see a lot of these local orders, guys that are going to feed a few (cattle) locally. They’re starting to buy now and finally get things ready to go…

“I’m not sure what’s going to be available for grass after the New Year. I think a lot of the first-cut cattle have probably went to town and been marketed already. There’s definitely going to be a lot less cattle backgrounding this year than normal.”

Slawinski added that as supply dwindles, cattle prices should rise heading into 2024.

“I think we could see prices return to where they were prior to when the pressure started being put on the market,” he said.

“Anybody who hasn’t bought grass cattle and are looking for grass cattle, they’re going to have to pay for them, for sure.”