Canola futures have improved by about $100 per tonne over the past month, trading in mid-October at their highest levels since the end of July. With seasonal harvest pressure in the rear-view mirror, a few underlying factors have shifted from bearish to bullish for canola.

Old crop carryout: A recent adjustment to 2023/24 canola ending stocks largely flew under the radar. Statistics Canada’s Oct. 8 report on soybean and corn stocks included a cut to its call on old crop canola carryout by about 300,000 tonnes. Now at 2.75 million tonnes, the cut led to a reduction in new crop carryout by a similar amount in Agriculture and Agri-Food Canada’s October projection.

AAFC now expects new crop ending stocks of only 2.2 million tonnes, but that estimate is based on production around 19 million tonnes.

Read Also

MANITOBA AG DAYS: Don’t wait to buy fertilizer, farmers warned

Higher fertilizer prices likely ahead, says Ag Days speaker. Farmers waiting until spring to buy fertilizer might end up eating the cost.

Production: Provincial crop reports and anecdotal reports from farmers place average canola yields well below StatCan’s optimistic call, and many in the trade now say actual production may have ended closer to 18 million tonnes. If true, that would leave ending stocks at only 1.2 million tonnes.

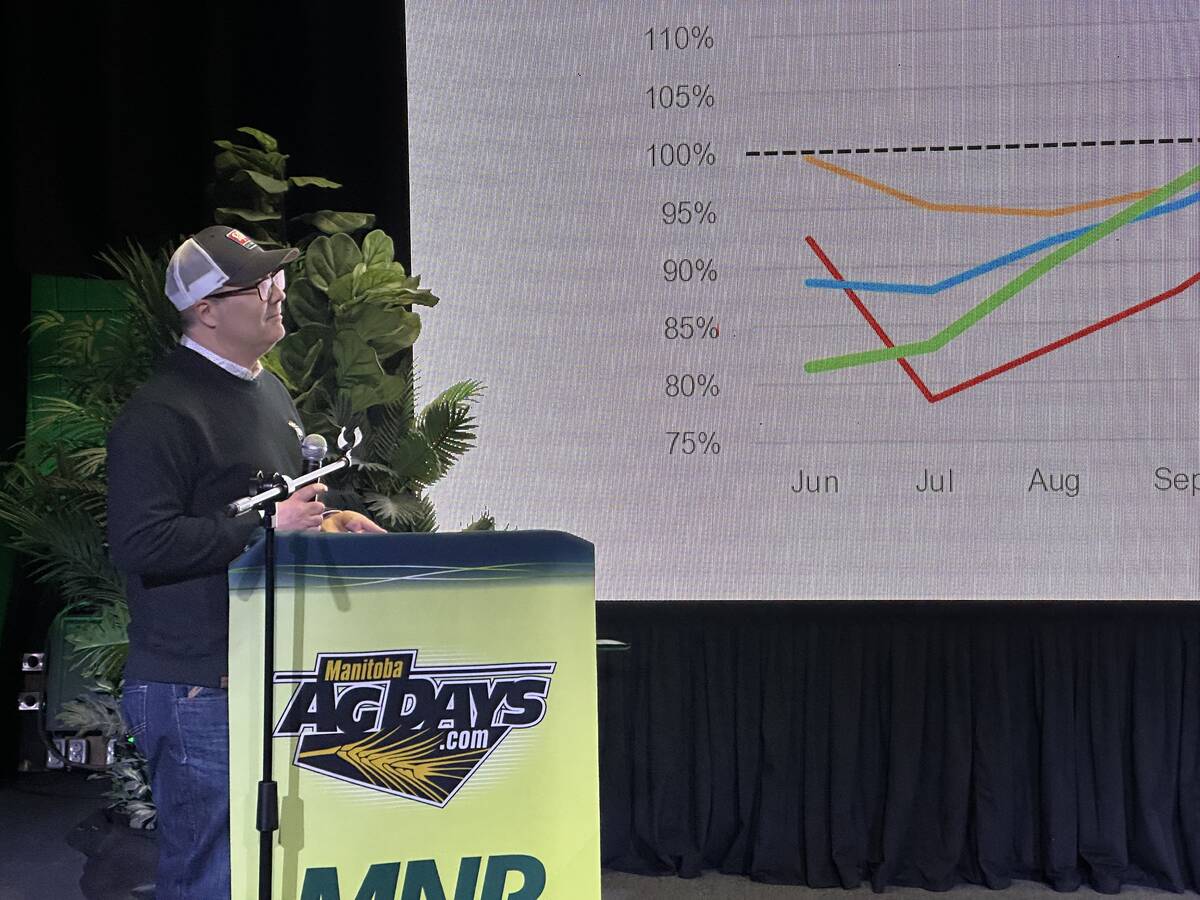

Exports: Canada exported 253,000 tonnes of canola during the week ended Oct. 20, bringing the year-to-date total to 2.6 million tonnes. That is already 1.5 million tonnes above what moved by the same time in the previous year. The country is on pace to export 12.3 million tonnes of canola in 2024-25. That’s a far cry from the 7.5 million tonnes forecast by Statistics Canada and the 6.7 million tonnes exported in 2023-24.

Rationing: The domestic crush is also running at a solid pace, with disappearance through 11 weeks of 2.5 million tonnes, up from 2.3 million tonnes at the same time in the previous year. The crush pace is unlikely to change, which means demand on the export front will need to be rationed and take prices higher. However, there are ideas that some buying interest may be heavily front-loaded this year, given uncertainty over a possible trade dispute with China.

Where now? The underlying fundamentals are supportive, and the charts are trending higher. However, a large U.S. soybean crop and improving South American production prospects mean any strength in canola may be relative to those outside markets.