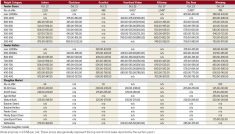

Glacier FarmMedia — For the week ending March 14, western Canadian feeder cattle markets traded $10-$15 per hundredweight higher than seven days earlier.

Feeder cattle prices recovered from the U.S. tariff-related weakness. Finishing feedlots were aggressive across all weight categories.

Many operations moved a portion of their cattle to custom feedlots in the United States to avoid the tariffs. This may have contributed to the higher risk tolerance now that the tariffs have been removed until April 2.

Read Also

MANITOBA AG DAYS: Unmoved China tariffs worrying for Manitoba pork

Manitoba pork producers and Agriculture Minister Ron Kostyshyn have both noted lack of progress on Chinese tariffs on pork.

There was limited slippage on fleshier replacements. Grassers were once again trading at or near record highs with ideas that yearling numbers will be down sharply come August.

Alberta plants were buying fed cattle on a dressed basis in the range of $450-$460 per cwt. delivered, up from the previous week’s values of $430-$450 per cwt. Using a 60 per cent grading, this equates to a live price of $270-$276 per cwt.

Break-even pen closeouts for March are in the range of $255-$260 per cwt. The healthy feeding margins are the main supporting factor. Market-ready fed cattle supplies in Alberta and Saskatchewan on April 1 are expected to drop to 81,000, down about 12,000 head from last year. This is a seasonal low. If the U.S. tariffs are once again paused in April, the Alberta fed market will need to ration demand by trading at a premium to U.S. values.

Fed cattle supplies will be extremely tight until mid-May. Feeding margins have potential to improve over the next 30 to 45 days, which could lift the feeder market $5-$10 per cwt. higher.

Market-ready fed cattle supplies in Alberta and Saskatchewan during May will increase to 150,000 head. This will be followed by a seasonal high of 280,000 head in June.

Even under a normal environment, the Alberta fed cattle market is expected to trend lower from mid-May though June and July, resulting in softer feeder prices

Feeders

The feeder cattle futures market continues to trend higher. For the week ending March 4, the managed money was a net buyer of 611 contracts while the commercial was a net seller of 33 contracts., which characterizes a bullish market.

As of March 14, the managed money long is estimated at a record 30,000 contracts.

The futures market will likely turn in May. Beware because the funds will all want to liquidate at the same time. The large fund position and the looming tariff threat encourages cow/calf and backgrounding operators to get their price insurance as soon as possible.

U.S. market

U.S. beef demand has potential to significantly decline in the summer months and result in softer U.S. fed and feeder cattle prices.

Since the COVID low of 2020, the Dow Jones Industrial Average has gone from 20,000 to a high of 45,000 in November 2024. After four years of growth though, the U.S. economy is entering a contraction phase.

Tariffs against major U.S. trade partners could shave 25-30 per cent off the equity markets. The Dow Jones has potential to be trading around 30,000-33,00 by the end of 2025.

Walmart Inc., Home Depot Inc. and Target Corp. have all raised concerns about weaker consumer spending. A one per cent decrease in consumer spending equates to a one percent decrease in beef demand.

This is the signal to make sure you have your price insurance on yearlings that will be sold in August or September. Make sure you have your price insurance on calves that will be sold in the fall.