Canada’s second-biggest grain handler now has all the approvals it needs to buy a substantial chunk of the No. 1 player.

Winnipeg’s Richardson International said Thursday it’s received confirmation from the Competition Bureau of Canada to go ahead and seal its deal with Glencore International. The Swiss commodity firm on Monday became Canada’s No. 1 handler after completing its $6.1 billion takeover of Viterra.

Among other assets, Richardson’s $800 million-plus deal with Glencore will give it 19 of Viterra’s Prairie country grain elevators, plus the crop input retail centres attached to those outlets, bringing the two companies relatively close to each other in Canadian grain handling capacity.

Read Also

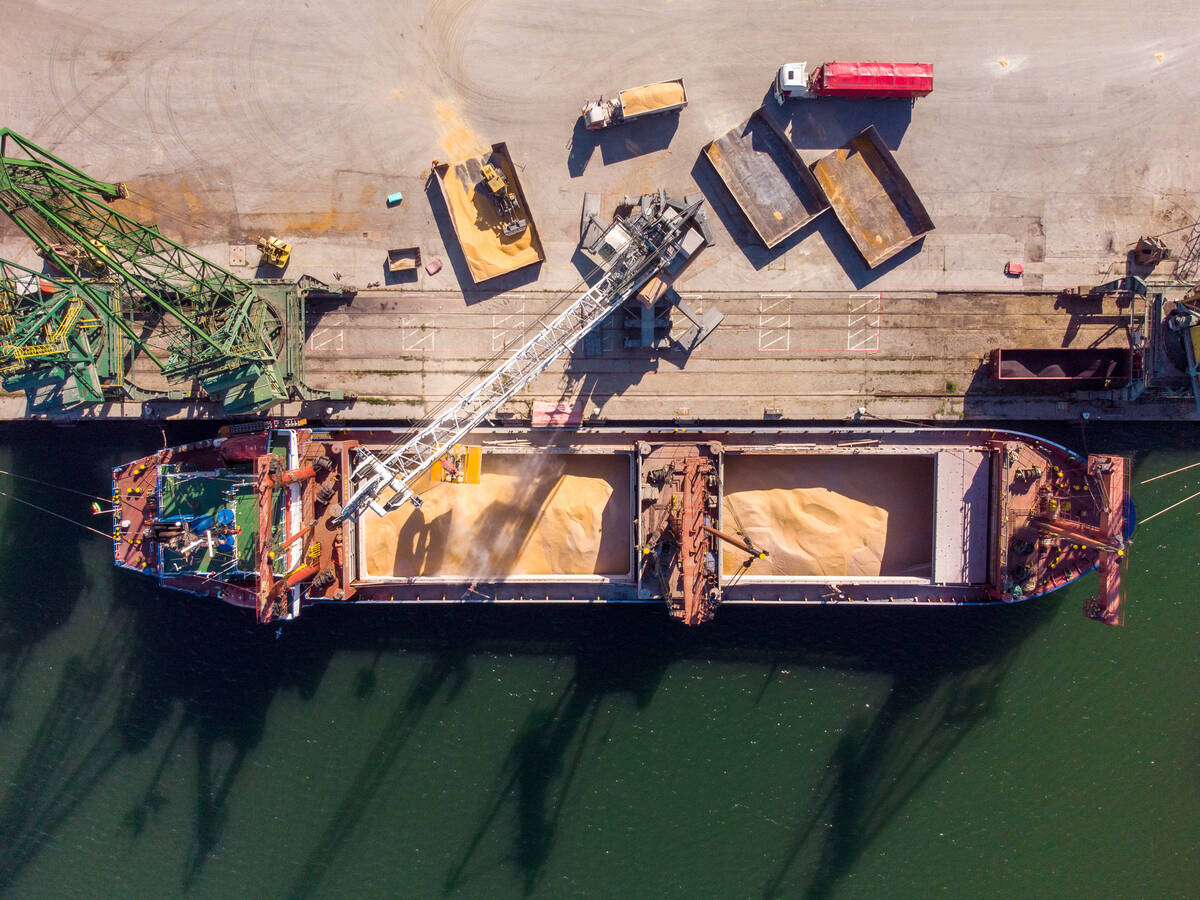

Ukraine wheat exports remain low amid Russian attacks on ports, weak demand

Ukraine’s wheat exports remained relatively low in the first half of January amid Russian attacks on Ukrainian seaports and low external demand, data from the country’s grain traders union UGA showed on Wednesday.

The Competition Bureau’s notice was the final approval needed for privately-held Richardson, which said it will now work with Glencore to close the deal “as soon as possible in 2013.”

Richardson president Curt Vossen said Thursday the Viterra assets will “allow us to provide western Canadian farmers with more choice in the marketplace and improved access to products and services.”

Richardson’s deal with Glencore — announced in March when Glencore confirmed it was Viterra’s buyer-in-waiting — also includes a 25 per cent ownership stake in the Viterra-operated Cascadia port terminal at Vancouver and another Viterra port terminal at Thunder Bay, Ont.

The purchase also includes Viterra’s Can-Oat Milling business, which includes oat milling and processing plants at Portage la Prairie, Man., Martensville, Sask. and Barrhead, Alta.

Along with those plants, Richardson will buy the U.S. milling operations of 21st Century Grain Processing, which Viterra bought in 2010, including an oat milling plant at South Sioux City, Nebraska and a wheat mill at Dawn, Texas. Can-Oat and 21st Century combined made Viterra the largest oat miller in North America.

Retail

As of Thursday the Competition Bureau hasn’t yet granted its blessing to Glencore’s other sale of Viterra assets, a $915 million deal with Calgary-based fertilizer and ag retail giant Agrium.

The number of ag retail stores going to Richardson is “a fraction of what we’re buying,” so Agrium doesn’t expect Competition Bureau approval to come as quickly as it did for Richardson, Richard Downey, Agrium’s vice-president of corporate relations, said Thursday.

Agrium’s deal with Glencore would give it 232 of Viterra’s 258 Canadian agri-product retail outlets, as well as all of Viterra’s 17 ag retail facilities in Australia. Agrium has noted its current Crop Production Services retail business has only a “limited” presence in Western Canada.

Agrium’s planned purchase in March, then worth $1.15 billion, had also included Viterra’s 34 per cent stake in a Medicine Hat, Alta. nitrogen fertilizer processing plant, but it gave up that stake in a separate agreement announced in August.

Glencore will now sell the minority stake to U.S. fertilizer firm CF Industries for about $175 million plus working capital.

Glencore said Monday it “will continue to support” the Viterra assets in question until the deals with Richardson and Agrium are completed.

Related stories:

Richardson to boost West Coast port grain storage, Oct. 1, 2012

Agrium pressured for change in proxy battle, Nov. 19, 2012

That’s a wrap: Glencore now running Viterra, Dec. 17, 2012