Fewer new combine sales in Canada and the U.S. are just business as usual and probably a lingering effect of the pandemic, says one ag machinery leader.

Why it matters: Some analysis suggests lower crop prices are affecting combine purchases. The North American Equipment Dealers Association has a different view.

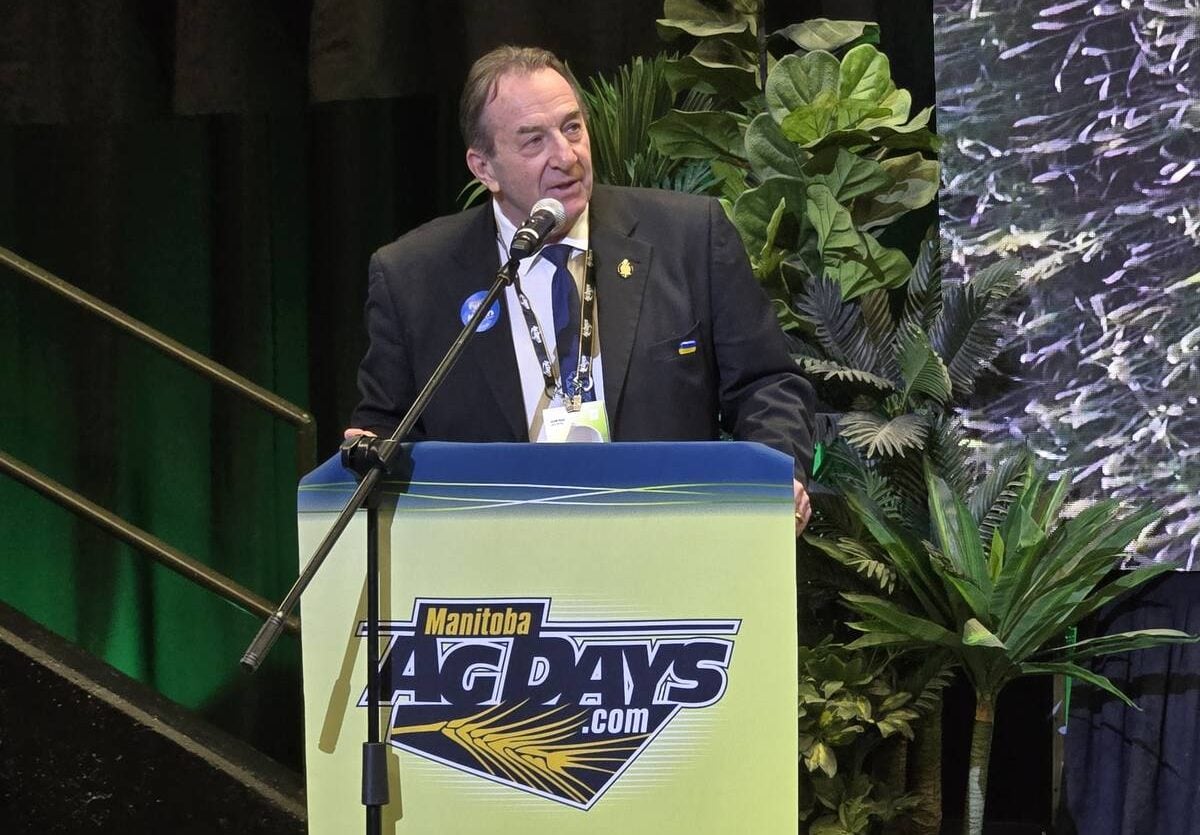

Although sales may suggest “a little bit” of a downturn, Kim Rominger, chief executive officer of the North American Equipment Dealers Association, says reasons date back to the pandemic, when new combines and other equipment were hard to find and used machines were purchased instead.

Read Also

Manitoba crop insurance expands wildlife coverage, offers pilot programs

New crop insurance coverage is available to Manitoba farmers.

Once supplies of new equipment resumed, farmers traded in their used combines and bought new ones. Since those days, there hasn’t been as much impetus to buy new again.

“These cycles are regular in our industry,” said Rominger. “And we’re in the start of that cycle again where everybody’s loaded with their equipment. They’re happy and most of it’s new. There’s not a lot of used equipment out on the farms anymore, so it’s going to take a year or two to cycle this through.”

That’s good news for producers who are in the market for a used combine, he noted. The machines traded in for new machinery after supply chains untangled are still on dealers’ lots.

“There’s tons of good used machines out there; one- and two-year-old machines you can get for great, great prices right now.”

Alberta’s interpretation of July combine sales figures, drawn from the Association of Equipment Manufacturers, wasn’t so rosy. Although sales were generally better in Canada than in the U.S., a late-August news release from Alberta Agriculture and Irrigation suggests that declining farm financial fortunes might be affecting the market.

Good crop prices and record-high farm income may have previously buffered the effect of rising combine prices on buyer behaviour in Canada, the release said.

“Recent data from the Association of Equipment Manufacturers show combine sales in Canada up 5.7 per cent year-to-date in July, while U.S. sales are down nearly 18 per cent year-to-date,” read the release.

“Sales in Canada for the month of July 2024, however, are nearly 28 per cent lower compared to July 2023,” it noted. “This may indicate tougher market conditions ahead.”

The association data pertained specifically to self-propelled combines.

August sales data from the association painted an even grimmer picture. Total U.S. sales of self-propelled combines dropped 19.6 per cent year over year, while Canadian sales dropped 36.5 per cent compared to August 2023.

Looking at 2024 cumulatively, the year-to-date sales of self-propelled combines in Canada in August dropped half a per cent. U.S. year-to-date sales took a 17.9 per cent hit.

Rominger identified volume as the primary cause of the large discrepancy between U.S. and Canadian sales in July.

“The volume is much larger down in the States than up in Canada. You’ve got tremendously large operations up in Canada and you have tremendously large dealers in Canada covering very large swaths of land. You have some of that in the U.S., but not to the extent it is up here.”

The Alberta release also noted the technology-rich nature of newer combines may be negatively impacting consumer demand.

Tech is “absolutely” driving the cost of new combines and other farm equipment, said Rominger, but he argued that new technology in ag is inevitable and ultimately welcome. He cited the multi-company race to be the first to get an autonomous combine to market.

He predicts these machines will be initially be purchased by early adopters but will eventually become less expensive and more popular as the years pass.

Inflation is also playing a major role, according to the Alberta release. Although the price of a combine has increased in real terms, general inflation has “contributed substantially” to higher sticker prices.

The release also referenced the effect of the exchange rate between Canada and the U.S. As of Sept. 12, the Canadian dollar was worth 74 cents U.S., according to Google Finance.

“Many combines sold in Canada are manufactured in the U.S. … Combine prices seem to be more suppressed when the Canadian dollar is strong vis-a-vis the U.S. dollar, such as the period from 2010 to 2012, than when the Canadian dollar is weak,” the release noted.