Retail investors have continued to crowd into the broad commodity-fund sector even after prices for corn, wheat and soybeans reached 2-1/2-year highs this year, an analysis of fund flows showed.

The growth of “alternative” investments is partly the result of lessons learned after the financial collapse of 2008-09, which includes the importance of diversification as well as a desire to hedge potential inflation, analysts said. Commodities generally perform well in times of price inflation, especially when compared with investments like fixed-income securities.

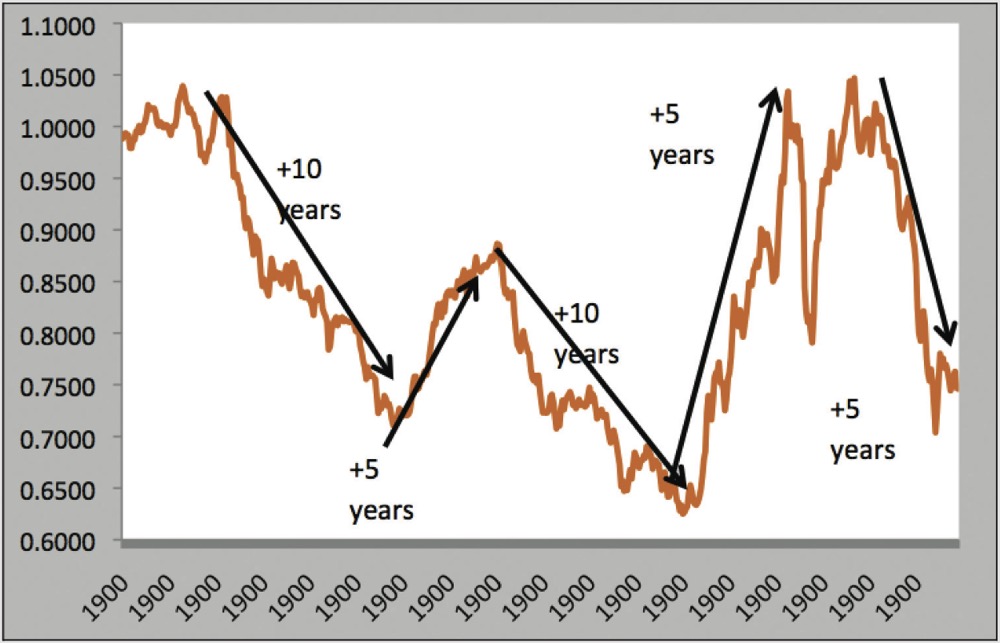

“Agricultural commodities have room to run,” said Morningstar analyst Abraham Bailin, who specializes in exchange-trading funds. Drivers of the run-up include “loose” U.S. monetary policy and U.S. dollar weakness, as well as demand from a growing world population, especially in developing nations, he said.

Read Also

MANITOBA AG DAYS: Unmoved China tariffs worrying for Manitoba pork

Manitoba pork producers and Agriculture Minister Ron Kostyshyn have both noted lack of progress on Chinese tariffs on pork.

The flow of money into ag sector mutual funds totalled $21.77 billion last year.

The commodities funds segment, which invests primarily in equity securities of companies involved in the production or trading of physical commodities or derivatives, took in an estimated $14.98 billion in 2010.

The data shows that within that commodity-fund total, agricultural funds – non-equity investments in agricultural commodity derivative instruments or physicals – drew an estimated $2.65 billion last year.

Agricultural funds’ one-month average return was a modest 1.89 per cent, while the three-month average was more robust at 22.39 per cent and the average one-year return was a whopping 47.50 per cent, surpassing that of the metals category, which logged a 32.37 per cent one-year average.