After a long winter, plants are starting to shoot up.

Similar activity can be seen in the wheat market. Values broke dormancy during the week ended April 26.

Charts: Minneapolis spring wheat gained 55 cents per bushel in the span of a week, while Kansas City hard red winter wheat was up by 65 cents. Some chart indicators were nearing overbought levels, but the technical charts overall were shifting higher.

Read Also

Canada’s oat crop looks promising

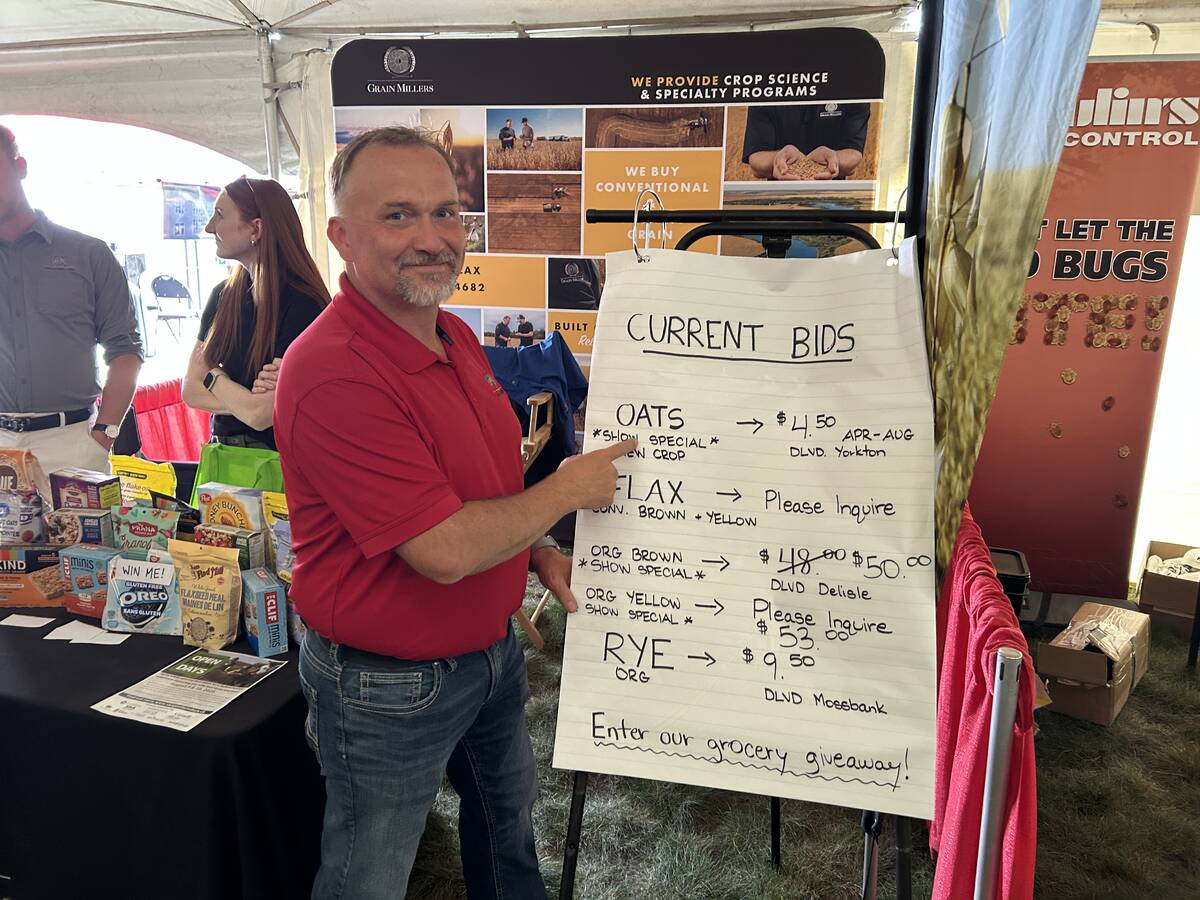

Oat market demand is strong. At the same time, Canada’s planted oat area is up an estimated 2.6 per cent from last year and 2025 yields may be up 2.8 bushels to the acre.

Speculative fund traders were still sitting on large net short positions in wheat at the beginning of April, but the rally saw them bail out of some bearish bets. Whether they go long remains to be seen, but the futures could see more upside as the technical outlook shifts. The latest strength in wheat could also spill over to underpin other agricultural commodities.

U.S. condition ratings: Timely rains may have eased some dryness concerns, but drought issues persist in many key wheat growing regions of the United States. The winter wheat harvest in the Southern Plains is just around the corner, creating opportunities for more weather rallies. However, seasonal harvest pressure looms.

Black Sea: Ongoing conflict between Russia and Ukraine remains a feature of the wheat market. A Russian attack on Ukrainian grain storage facilities on April 19 provided a catalyst for the rally in U.S. futures. The latest strike highlights lingering uncertainty over grain movement through the Black Sea.

In addition, dry weather has likely cut into Russian production prospects, although the country remains a major source of cheaper grain on the world market.

India: India is the wild card. It is one of the world’s largest growers and consumers of wheat, but typically is self-sufficient and not a global player. However, after two years of adverse growing conditions and lower yields, Indian wheat stocks have dropped to their tightest in 16 years.

The government has released some wheat from its strategic reserves, but there’s talk that it may need to import wheat for the first time since 2017.