Canola took a tumble to close out the week ended April 11, pressured by losses in Chicago soyoil and other oilseeds.

The old crop May canola contract fell back from the week’s high of $643.10 per tonne at the close on April 5, and fell to $624.30 on April 11. Declines for the new crop November contract were not as severe, dropping from $659.70 to $645.30. Despite those pull backs, canola remained firmly rangebound.

Some kind of notable movement in canola futures was coming, as the 20-day and 100-day moving averages for the nearby May contract converged. In a short time, they narrowed to about $5/tonne and then to less than $1.

Read Also

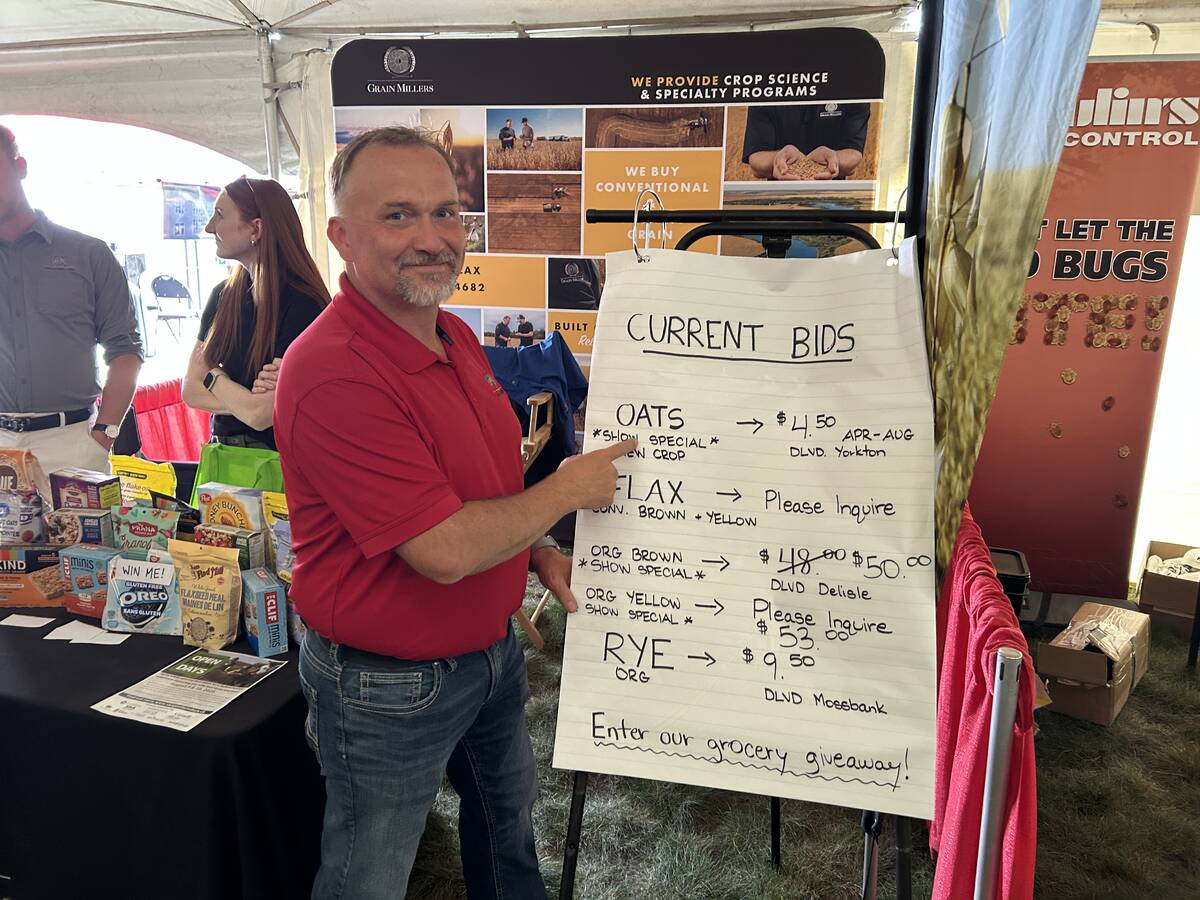

Canada’s oat crop looks promising

Oat market demand is strong. At the same time, Canada’s planted oat area is up an estimated 2.6 per cent from last year and 2025 yields may be up 2.8 bushels to the acre.

Where canola goes remains to be seen. The forecast of rain for the Prairies will bode well for early planted crops, but there is a strong possibility that dry conditions will continue across the region. The drier the Prairies become, the more likely canola prices will increase.

Any dryness will affect production’s outcome. Agriculture and Agri-Food Canada projected production for 2024-25 at 18.10 million tonnes. The United States Department of Agriculture has yet to issue its official estimate on how much canola Canada will grow in the coming marketing year, but its attaché in Ottawa estimated output at 18.07 million tonnes.

Private estimates will be generated as spring planting proceeds until Statistics Canada releases its first model-based production estimates in late summer.

Until that occurs, prices for canola and the Chicago soy complex will feel pressure from the still large South American soybean crops. Although Brazil is far from setting a new production record, the USDA estimated its bounty at 155 million tonnes while Brazil’s equivalent agency, Conab, projected the crop to be 146.52 million tonnes. It’s a hefty harvest either way.

For Argentina, the world’s third largest soybean grower, the USDA indicated output at 50 million tonnes. Then the Buenos Aires Grain Exchange trimmed 1.5 million tonnes from its call, now at 51 million. With either number, that’s pretty much double what Argentina gleaned from the previous year’s drought-stricken harvest. Any losses in Brazil will be handily made up by a vastly improved Argentine crop.

With so many soybeans on the world market, that pressure will be a pretty strong influence on soyoil, as well as canola.