Canola prices spent the last full week of July vacillating between increases and decreases as the market shifted into a wait-and-see mode on this year’s crop on the Canadian Prairies.

There’s zero doubt the 2023-24 canola harvest won’t make the 18.8 million tonnes projected by Agriculture and Agri-food Canada. Drought and excessive heat across most of the Prairies took care of that.

However, in the week leading up to July 27, there had been at least enough rain across the region to help stabilize this year’s crop.

Read Also

Canada’s oat crop looks promising

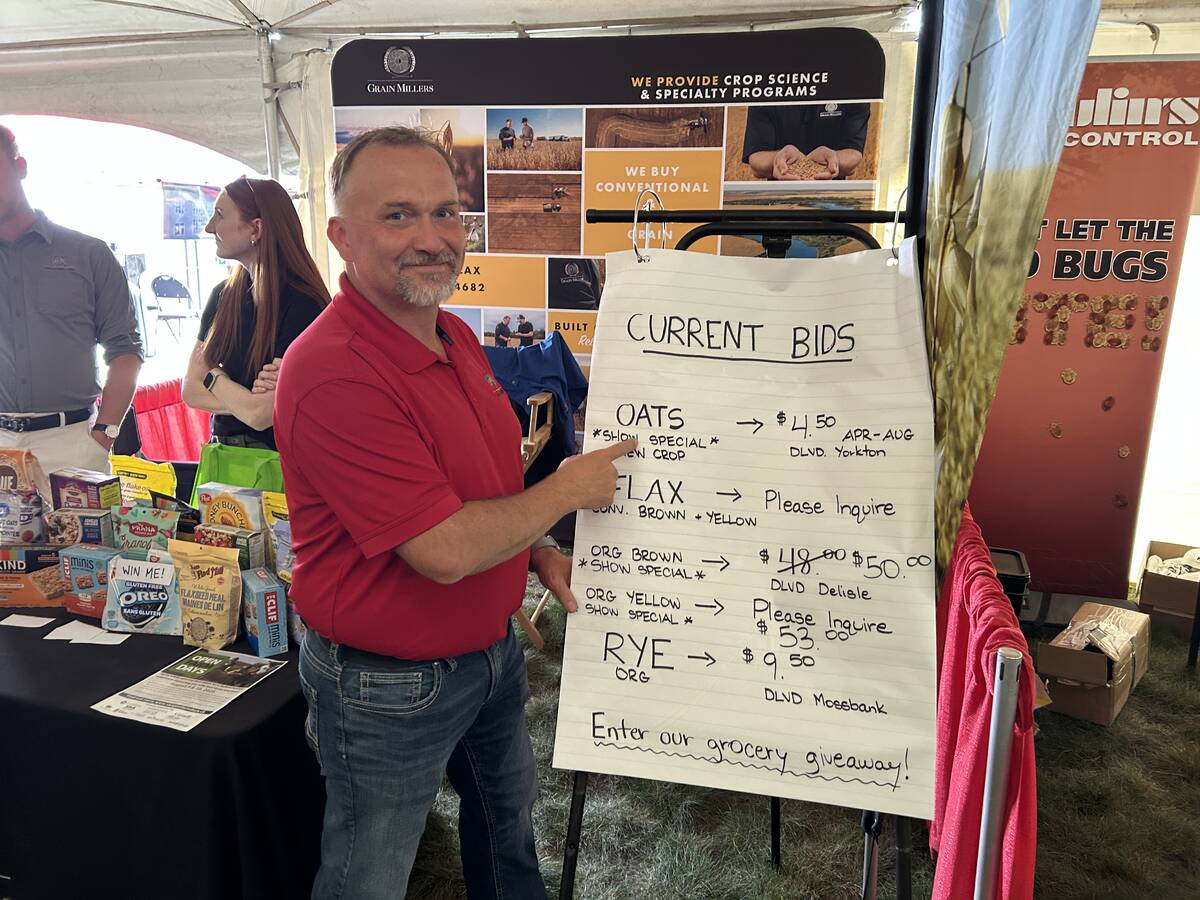

Oat market demand is strong. At the same time, Canada’s planted oat area is up an estimated 2.6 per cent from last year and 2025 yields may be up 2.8 bushels to the acre.

The spreaders also made their presence known on the canola market this week. They shifted between buying Chicago soy oil and selling canola and buying canola and selling soy oil. There was enough momentum in the spreaders’ actions that the Canadian oilseed displayed some independent strength, running contrary to losses in other comparable oils.

For now, trade will watch the crop as July moves into August.

Adequate and timely rainfall should continue to keep canola on steady footing, but any significant return of the heat and lack of precipitation could easily drive down those production expectations.

Some analysts have already called for a harvest of less than 18 million tonnes.

Regardless of where harvest numbers end up, one thing is certain: ending stocks will come in below the already very tight 600,000 tonnes AAFC has anticipated.

With that in mind, the latest grain movement report from the Canadian Grain Commission continued to highlight that 2022-23 numbers are well ahead of those from the previous year. With one week left for the organization to report on, producer deliveries of canola were just over 18 million tonnes. That’s an improvement of almost 30 per cent over 2021-22.

Canola exports rebounded significantly, now at eight million tonnes, besting last year by 58 per cent. Domestic usage remained slightly ahead of 2021-22 as well at 10 million tonnes, up 9.3 per cent.

All in all, the current crop year has been a pretty good one.

Prices were not going to remain astronomically high, but they recovered from weaker prices seen only a few months ago. Canola appears to be firmly entrenched to stay above $800 per tonne for the time being. Depending on the outcome of the harvest, those new crop contracts could climb higher or stand pat.