As the canola harvest across the Canadian Prairies picked up speed at the end of August, prices for the Canadian oilseed bounced back and forth on ICE Futures.

Support came from soyoil on the Chicago Board of Trade, when the commodity was climbing higher, while European rapeseed and Malaysian palm oil provided spillover as well. And as crude oil prices pushed higher, they underpinned canola and the other vegetable oils.

But the canola market has changed a little over the last week. Any thoughts of prices cranking up to $840 per tonne dissipated during the Aug. 29 session.

Read Also

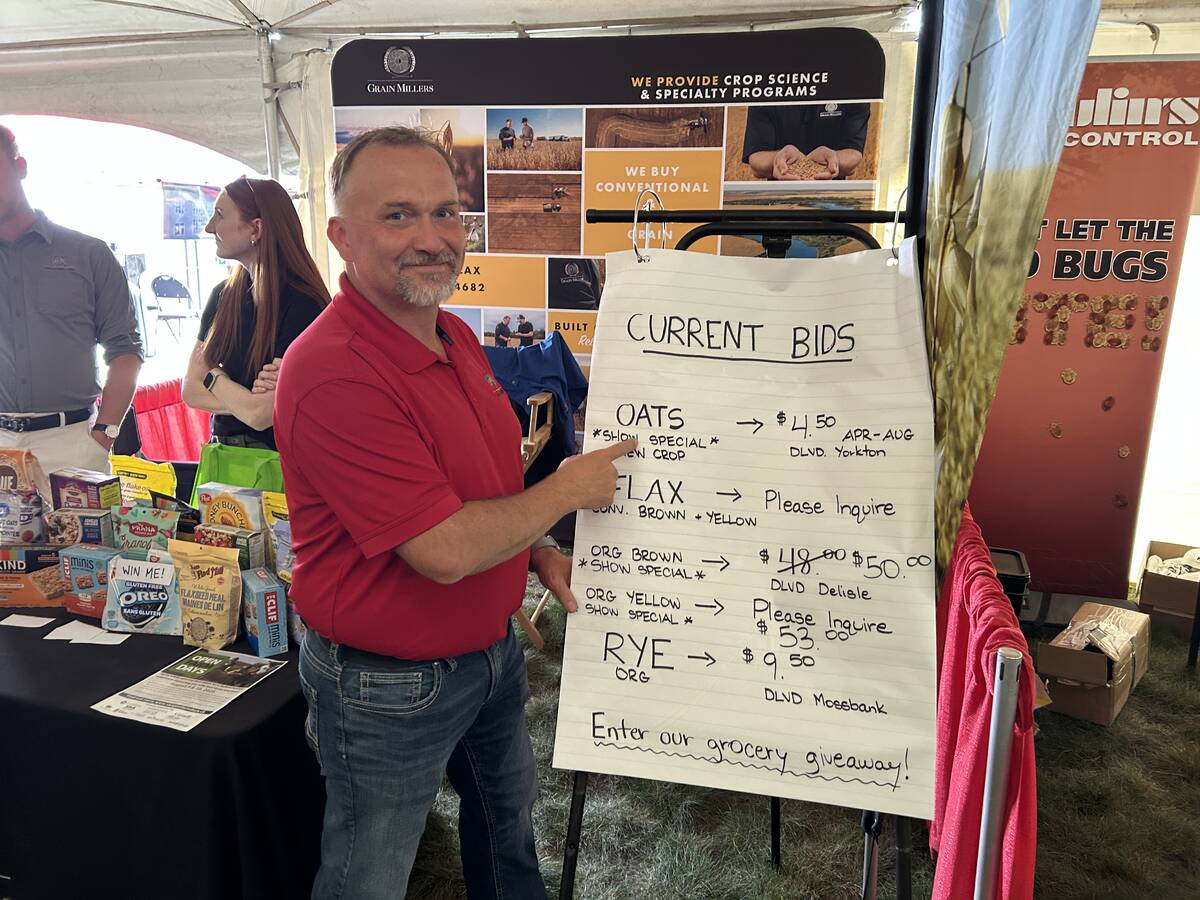

Canada’s oat crop looks promising

Oat market demand is strong. At the same time, Canada’s planted oat area is up an estimated 2.6 per cent from last year and 2025 yields may be up 2.8 bushels to the acre.

That morning, Statistics Canada issued its long-awaited model-based production estimates, with 2023-24 canola coming in at nearly 17.6 million tonnes. While that was close to the average trade guess of 17.4 million tonnes, it was below 2022-23 production of 18.7 million.

Up went ICE canola futures, hitting double-digit gains during the morning.

Then, as the afternoon approached, those gains faded lower and lower. The ‘umph’ from the report burned off much quicker than expected. At the close that Tuesday, increases in canola ranged between $2.20 and $2.70 per bushel.

Other elements carried more weight than the StatCan report. One was soyoil, with its ebbs and flows, along with similar movement in crude oil.

More important was the amount of farmer selling. Producers looked at the prices they could get for their wheat or barley and essentially closed the bin doors. Needing an influx of cash, they turned to canola, which offered much better pricing.

Expectations are that more canola will flow into the market as the oilseed’s harvest picks up the pace. In Manitoba it has barely started, at five per cent complete, but it’s double that in Saskatchewan. At the time of writing, Alberta had yet to release its crop report, but as of Aug. 22, the province’s canola harvest was one per cent finished, with the bulk of progress in the drought-stricken south.

Thoughts quickly turned to the next set of production estimates StatCan will publish in September. Already, ideas that those numbers will be revised upward have been bandied about.

The August report took a look at crops as of July 31. The next report takes its look as of Aug. 31. The thinking is that crop conditions on the Prairies generally improved during August and early yield results may not be nearly as bad as initially thought. That means a canola crop of more than 18 million tonnes is a possibility.