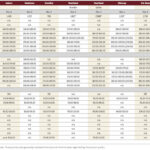

Compared to last week, western Canadian yearling prices were steady to $2 lower; calves traded $2-$4 below week-ago levels. Saskatchewan and Manitoba experienced their first major snowstorm of the season last week. The market tends to incorporate a risk discount for adverse weather as buyers factor in higher death loss. Also, major feedlot operators believe